Broad-based commodity super-cycle - finally a megatrend from an old economy sector

by Shishir Ranjan. Published on 04 Nov 2021

You might wonder why a Hong Kong domiciled tech-focused firm such as ours has anything to do with Metals or Mining. We have been actively investing in mining assets through our newly launched venture opportunities fund. This private equity strategy is in partnership with EMC (Emerging Markets Capital Ltd.), a highly specialized investment company with an impressive track record of identifying and monetizing mining exploration assets, generating outstanding returns at exit. You can find more about our investment strategy towards the end.

While we rarely venture outside the technology universe or sustainability themes, we were compelled by the opportunity created by some of the demand-supply imbalances in the metals sector and its relevance & importance to some of our core investment themes including electric mobility, semiconductors and clean energy.

On the supply-side, the long-running capital flows into new economies and underinvestment in the mining space, has created massive supply-side imbalances, and these shortages, especially in a long-cycle industry such as this one, will translate to high commodity prices over a prolonged period of time.

There are significant global macro tailwinds impacting the demand side of the equation, with examples ranging from infrastructure, stimulus, QE, weaker USD, inflationary concerns and others. However, the ones we are excited about are much more intrinsic -

Direct impact green metals have on overall decarbonization targets,

Growing demand for electric vehicles with sales penetration expected to be as high as 60% in certain markets by 2030.

We have put together some interesting views from the street and inputs from our partners to help everyone appreciate some of the unique dynamics at play in Copper, Silver and Gold. Enjoy!

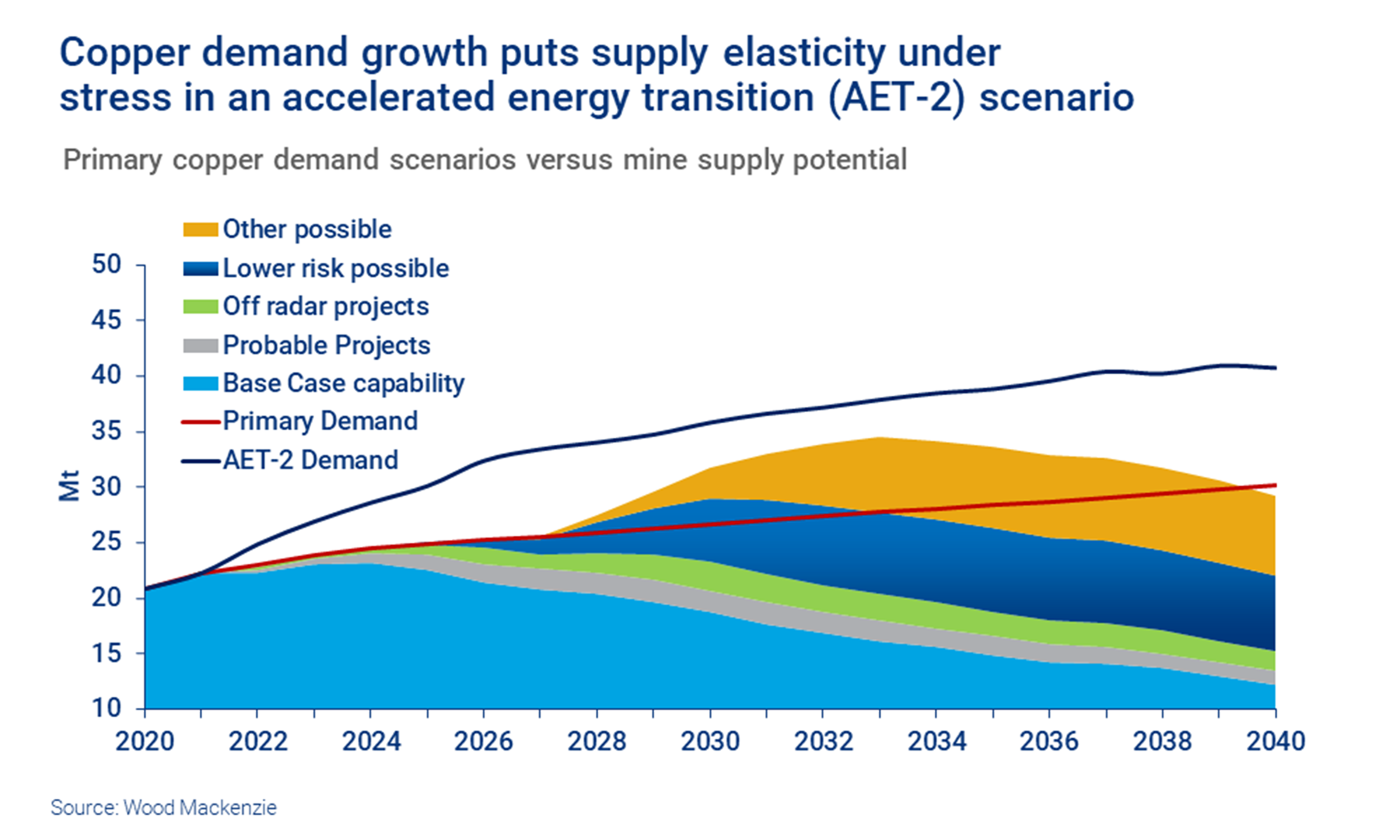

Copper | Quotes, highlights and a Graph

“Copper will need to rise 50% further from its current near-record high to encourage enough new mined supply to meet rampant demand” - Ivan Glasenberg, chief executive officer of Glencore Plc.

“The “green” transformation and decarbonization plans drive the copper demand as this metal has a wide range of energy applications, being heavily used in EV production and infrastructure. However, output from the copper projects in the pipeline won’t be enough to cover the increased demand, resulting in a large supply deficit in the next 5 years. Securing a copper deposit and advancing the project within this timeframe are one of the key success factors in these market conditions.” - Team EMC

Copper will have a central role in the coming green revolution. It has a unique chemical structure that gives it a range of useful properties like ductility, electrical conductivity, thermal conductivity, low reactivity, etc making it the first-best affordable material for use in cables, batteries, transistors, and inverters – all key technologies on the path to net-zero.

It also has the necessary physical properties to transform and transmit electromagnetic (solar), kinetic (wind) and geothermal energy to their useful final state, such as moving a vehicle or heating a home.

Net-zero by 2050 would approximately double renewable power capacity and take copper demand to 8.4mt by 2030, or 35% of copper supply.

Electric vehicle revolution needs copper and this is not just for the batteries but also for motor coils, inverters and wirings. For example, EV charging points contain 1 to 7 kg of copper AC chargers and 25 kg for DC chargers. Similarly, EV motors require copper coils. A standard copper consumption for an EV is in the range of 60-83 kg. Lithium-ion batteries that power EVs contain copper in the range of 0.5 kg/kWh to 0.7 kg/kWh. Goldman Sachs expects EV related copper demand to grow 31% annually for the rest of the decade.

The copper market is already tight due to the hiked demand and stagnant supply given the poor returns and ESG concerns.

Copper mining is a delicate and time-consuming process making Copper a long-cycle commodity. It takes years to set up a new mine or to extend an existing mine.

Supply constraints are not only from a lead time perspective but it has also become difficult to find new copper and quality (ore grade) copper.

According to Glencore, the copper price needs to be at USD 15000 a metric ton to explore newer and difficult mines to offset the risk. Currently copper is trading at ~USD 10000 a metric ton.

Lead time for new supplies for copper along with surging demand is creating a super cycle for this metal.

Silver | Quotes, highlights and a Graph

Silver | Quotes, highlights and a Graph

“Silver should gain from the “best of both worlds” narrative. In other words, silver will benefit both from its precious metals credentials, against the backdrop of low-interest rates and concerns about inflation, and its industrial metal ones, given a synchronized post-pandemic recovery and policy-makers focus on silver-consuming green energy applications.” - The Silver Institute

“There are comparatively fewer silver companies in the space and we expect to have strong demand for silver with main drivers being industrials (electronics, EVs) and jewellery. High-grade, district-scale projects provide a competitive advantage in an environment of resource scarcity.” - Team EMC

Low-interest rates, a weaker U.S. dollar and rising inflation pressures will drive both gold and silver, which are both seen as monetary metals. However, improving economic activity next year will add another pillar of support for silver.

Silver along with Gold plays the role of a real asset, a currency that generally keeps its value through fiat currency devaluation cycles.

Automotive: Silver's superior electrical properties make it hard to replace across a wide and growing range of automotive applications, many of which are critical to safety and to meeting increased environmental standards.

Silver is found in many car components throughout vehicles' electronic systems. These components include, but are not limited to, conductive pastes in automotive glass, circuit-breakers and fuses, switches, and relays used to activate varying electronic devices.

Silver is also used in a wide range of vital safety features, such as airbag deployment systems, automatic braking, and security and driver alertness systems.

The silver institute expects global automotive demand for silver to be 88Moz (Million ounces) by 2025 from the current 50Moz, a growth of 76%. Cumulative electric vehicle (EV) sales are set to increase to 34 million across the world in 2025, forecasts a study by Frost & Sullivan. The study also says that the number will reach 121.2 million in 2030, and 636.7 million by 2040.

Clean energy: Solar, or photovoltaic (PV), panels currently consume a robust segment of the silver market, accounting for approximately 100Moz a year.

Even though ‘thrifting’ (a process of reducing expensive and rare metals with alternatives in a process) has reduced silver demand per solar cell from 521 milligrams in 2009 to 111 milligrams in 2019 but due to the growing demand for clean energy, the total demand for silver for solar panels to grow 85% to ~185Moz in 10 years.

Semiconductor: According to The Silver Institute, demand for silver in chips, IoT devices, smartphones or other tools, are expected to increase annual silver demand from 7.5Moz currently to 23Moz by 2030.

Although the silver market is projected to achieve a physical surplus in 2021 (total demand vis-à-vis total production), it should be the lowest since 2015’s deficit.

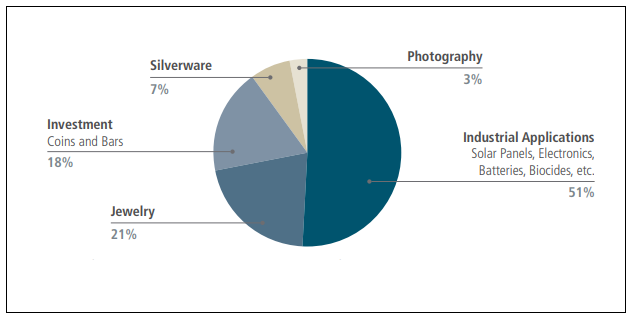

Industrial Buyers Drive More than 50% of Silver Demand

Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS. Data as of Jan 2020

Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS. Data as of Jan 2020

Gold | Quotes, highlights and a Graph

“Gold benefits from diverse sources of demand: as an investment, a reserve asset, jewelry, and a technology component. It is highly liquid, no one’s liability carries no credit risk, and is scarce, historically preserving its value over time” - World Gold Council

“Large district-scale deposits have been depleted and the ones still having reserves are being mainly operated by tier-1 market players. Such deposits are scarce and large-cap companies follow the M&A route to grow their resource base inorganically. Therefore, high-grade, district-scale deposits have a great potential to become the number one acquisition target.” - Team EMC

2020 has been a good year for Gold reaching an all-time high spot price of $2,075/oz on the back of strong investor interest due to Covid induced global economic uncertainties as well as large-scale fiscal stimulus measures in major economies.

Gold has also been helped by a reduction in interest rates including 150bps of benchmark rate cuts by the US Federal Reserve during March 2020 to a range of 0% to 0.25% and a continuation of negative 10-year yields in parts of Europe, which helped to increase gold prices by reducing the opportunity cost of holding gold.

Economic stimulus and a search for safe-haven assets created exceptional demand for gold in 2020 with collective ETF gold holdings grew by a record 877 tonnes during the year and reached an all-time high of approximately 3,752 tonnes (World Gold Council).

Historically, Gold being a safety asset, performed well during equity market pullbacks. It also has a good correlation with inflation: whenever inflation has been higher than 3%, gold’s price increased 15% on average. Interestingly, Oxford Economics research also shows that gold performs well in a period marked by low-interest rates and high financial stress, a sign of deflation.

Gold has a dual nature as a commodity as well as an investment asset. For example, during an economic downturn, it becomes a go-to asset for investors while during the revival of the economy, consumption overtakes investment demand. Any selling pressure from investment outflow is taken care of by increased consumption demand ( for example, strengthening consumer demand helped to mitigate the impact of gold ETF outflows during Q1 2020 and provided an element of support to the gold price).

Gold has been outperforming fiat currencies and the major reason behind it is the limited supply growth in gold (~1.4% per year in the last 20 years) while on other hand, fiat money has been on a printing race to print in unlimited quantities to support monetary policy.

Global physical gold demand is expected to recover in 2021 on the back of expected economic recovery from its dismal performance during 2020 and given that positive correlation between economic growth and Chinese and Indian (the two biggest gold consumers, with a combined share of nearly 50%) demand, we believe that gold consumption in the region may continue to improve.

Gold is a unique commodity, scarce enough to hold long-term appeal but big enough to make it relevant for a wide variety of investors – including central banks. There are approximately 201,296 ton of gold above ground and mine production adds approximately 3,300 ton per year over the past decade, equivalent to an annual 1.8% increment of above-ground stocks. Mine production is also well-diversified across regions with no continent contributing more than 25% of mined output.

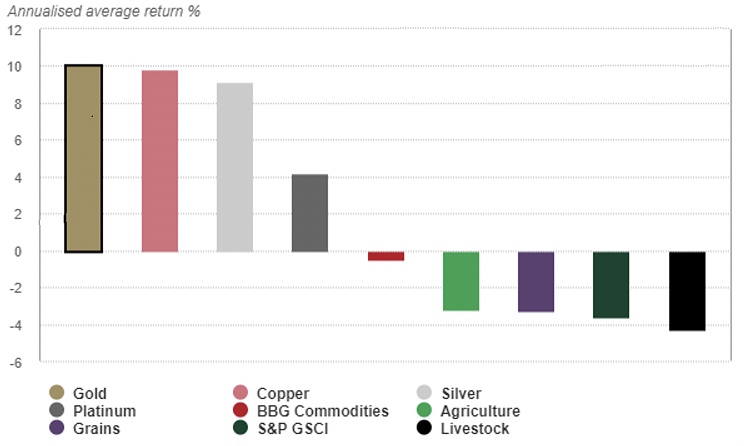

Gold has outperformed all broad-based indices and their individual commodity components - Average annual returns of commodity indices and key individual commodities over the past 20 years

Source: Bloomberg, World Gold Council

Source: Bloomberg, World Gold Council

Brief description of our investment strategy: The 'MCM Metals Opportunities Venture Fund' targets massively undervalued non-core assets of mid-tier producers or in Companies lacking technical/capital market expertise, then unlocking value by restructuring & infusing development capital and execution expertise, to finally exit through public markets (TSX, ASX). The fund has a multi-metal focus including Gold, Silver, Copper, Zinc, Cobalt and Lithium.

Written by Shishir Ranjan. shishir.ranjan@mcmpartners.com

Key references:

https://sprott.com/insights/silvers-clean-energy-future/# https://www.silverinstitute.org/global-silver-demand-forecasted-rise-11-percent-2021-reaching-1-025-billion-ounces/

https://www.silverinstitute.org/silver-supply-demand/ https://auto.economictimes.indiatimes.com/news/industry/electric-vehicle-sales-will-increase-to-34-million-in-2025-study/72288824

https://sprott.com/media/3546/silverautomotive_mmkttr2021.pdf

https://sprott.com/insights/silvers-clean-energy-future/#

https://www.silverinstitute.org/wp-content/uploads/2021/04/World-Silver-Survey-2021.pdf

Capital Markets

Secondaries

Confidential execution. Institutional-grade access. Secondary transactions done right.

Learn MoreInitial Public Offerings

Preferred allocations. Strategic positioning. IPO access done right.

Learn More